unemployment tax refund 2021 calculator

Gross to Net Net to Gross Tax Year. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

Unemployment Compensation Are Unemployment Benefits Taxable Marca

This way you can report the correct amounts received and avoid potential delays to.

. We can explain how the federal laws can. Taking advantage of deductions. You must file Schedule 1 with your Form 1040 or 1040-SR tax return.

This Estimator is integrated with a W-4 Form Tax withholding feature. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022. TAS Tax Tip.

Working closely with my office will maximize the amount of money you get to keep. The IRS reported that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust taxable income amounts based on the exclusion for unemployment compensation from previously filed income tax. If you are expecting a large income tax refund but need to file a Chapter 13 bankruptcy case contact the NJ bankruptcy law expert Robert Manchel at 866 503-5655 to discuss your options for bankruptcy protection.

I got my 2021 tax refund in like a week though lol. That provision didnt apply to 2021 benefits so you may receive a tax bill for your jobless benefits last year. 22 2022 Published 742 am.

This tax return and refund estimator is currently based on 2021 tax year tax tables. To reiterate if two spouses collected unemployment checks last year they both qualify for the 10200 tax break. It is mainly intended for residents of the US.

This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployement Income. Simply select your tax filing status and enter a few other details to estimate your total taxes. This is only applicable only if the two of you made at least 10200 off of unemployment checks.

If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file. However paying taxes on unemployment income and understanding how getting unemployment affects your tax return calls for a bit more explanation especially if you want to avoid unpleasant surprises at tax time. OLPMS - Instant Payroll Calculator.

See reviews photos directions phone numbers and more for New Jersey Tax Refund locations in Piscataway NJ. Use any of these 10 easy to use Tax Preparation Calculator Tools. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. These Tax Calculators will give you answers. Heres what you need to know.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

See reviews photos directions phone numbers and more for the best Tax Return Preparation in Piscataway NJ. Line 7 is clearly labeled Unemployment compensation 4 The total amount from the Additional. Generally unemployment compensation is taxable.

Basically you multiply the 10200 by 2 and then apply the rate. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Im still waiting for my 2020 unemployment refund.

People who received unemployment benefits last year and filed tax. The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. Originally started by John Dundon an Enrolled Agent who represents people.

The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive. There are a variety of other ways you can lower your tax liability such as. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS.

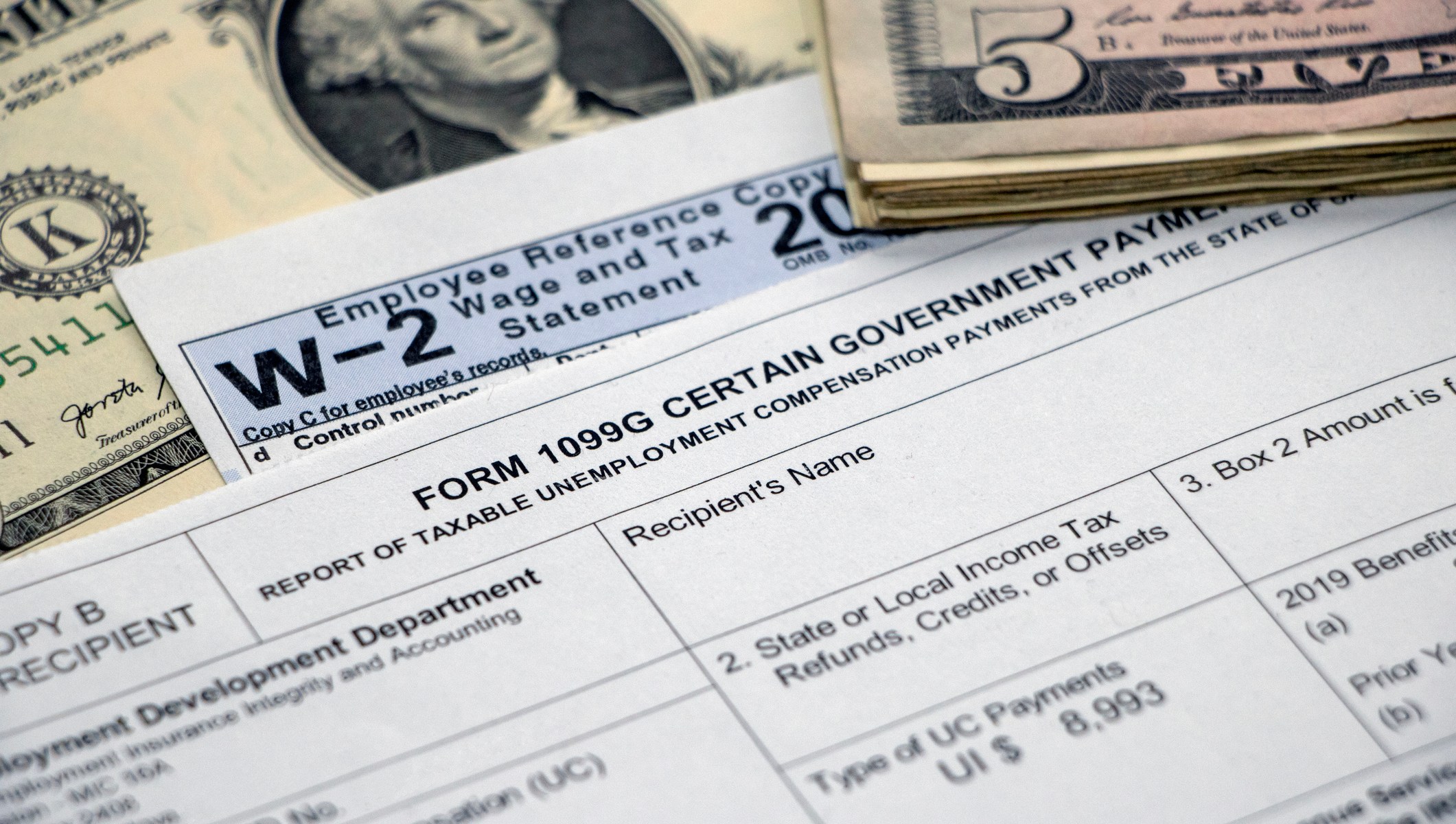

Unemployment pay1099-G retirement pay 1099-R. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT You can receive your unemployment benefits two ways. However this unemployment tax break applied only to 2020 tax returns.

Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. By far one of the most devastating economic impacts of the coronavirus crisis is.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Use this 2021 Tax Calculator to estimate your 2021 Taxes. In short yes unemployment income is taxed.

This calculator is perfect to calculate irs tax estimate payments for a. By Anuradha Garg. But in March the American Rescue Plan waived taxes on the first 10200 in unemployment income or 20400 for a couple who both claimed the benefit for those who made less than 150000 in adjusted gross income in 2020 in light of the coronavirus pandemic.

More 2021 unemployment compensation exclusion adjustments and refunds in some cases coming. In case you got any Tax Questions. This handy online tax refund calculator provides a.

4 days ago. COVID Tax Tip 2021-46 April 8 2021 However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. And is based on the tax brackets of 2021 and 2022.

The American Rescue Plan exempted 2020 unemployment benefits from taxes. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. OLPMS - Instant Payroll Calculator.

Direct Deposit into a bank account of your choice or via a Bank of America debit card If you choose the debit card method you may use them at any.

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

How To Estimate Your 2021 Tax Refund Tips Calculators And More Cnet

Why Is My Tax Refund Taking So Long Kxan Austin

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Calculator Estimate Your Taxes And Refund For Free

Faqs On Tax Returns And The Coronavirus

Where S My Refund 2021 Tax Returns May See Delays Wfla

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa